As the EU prepares to celebrate the 30-year anniversary of the Single Market, a new report by NERA Economic Consulting demonstrates the need for a fact-based discussion in the consumer goods industry, to provide even further benefits to consumers for the next three decades, and beyond.

The opening of borders in 1993 enabled a leap forward in the choice of innovative products available across the EU, as the internal market framework ensured legal certainty and fundamental freedoms to operate in the best interest of Europe’s consumers. Local traditions and cultural elements, taste preferences and social habits were not neglected, and continue to be very specific determining factors for local and regional market conditions within the Single Market.

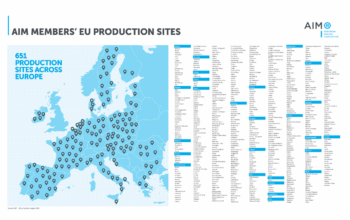

Published for AIM, the European Brands Association, the NERA report explains the facts of how consumer goods are sold across Europe. Brand manufacturers structure operations to deliver the best possible value for all stakeholders in the value chain, whilst remaining conscious of their legal obligations. Specific consumer information on ingredients or dosage to comply with existing local laws plays a role, as do differences in regulatory obligations at national level on packaging, recycling, and labelling requirements.

“We continue to ensure local taste and traditional preferences are served across markets, so that consumers still enjoy their favourite, trusted brands, many of which they have grown up with”, commented Michelle Gibbons, Director General of AIM. “At the same time, the Single Market has opened up whole new possibilities for consumers to experience other brands, flavours and tastes, which we now take for granted as they seamlessly cross borders, but it is important to remember how far we have come and to celebrate that.”

NERA shows that further regulatory hurdles need to be addressed to truly complete the Single Market, although much is already in place. For instance, the recently revised and adopted guidelines to the Vertical Block Exemption Regulation clarified that differentiated features on manufacturers’ products, such as different labels or languages, “are not in themselves restrictions of competition”, thereby confirming that various reasons can justify “measures that allow a manufacturer to verify the destination of the supplied goods”.[1]

On the issue of “territorial supply constraints”, the recent study by Valdani Vicari & Associati and London Economics (VVA study) falls short in its assessment, according to NERA, as it suffers from fundamental flaws both in its information basis and in its analysis of the prevalence and impact of TSCs on consumers. The authors of the VVA study themselves conceded that they found “no hard or documentary evidence of such behaviours”, and that none of the 17 national competition authorities surveyed had anything to report on the matter. It observed cross-country price differences equally for retailers own private label products as for branded manufacturers’ products. Unsurprisingly, the packaging assortments and prices of retailers’ own brands also vary greatly, depending on regulatory constraints and other relevant market factors.[2] More facts on differences in assortments can be found in AIM’s Insight Paper on this topic.